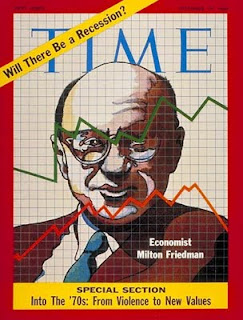

The editorial makes the case that without Milton Friedman being alive and available to push back against the more "Rothbardian" influences in libertarian and conservative/rightist circles, Rothbard kind of wins the day.

"As a veteran of the "free-market movement", I can attest to the remarkable influence of this line of thinking. Now, Milton Friedman was one of the 20th century's great economists as well as one its most formidable debaters. This made him a powerful check on the influence of anarcho-capitalist Austrians, obviously much to the chagrin of Rothbard. "As in many other spheres," Rothbard wrote, "[Friedman] has functioned not as an opponent of statism and advocate of the free market, but as a technician advising the State on how to be more efficient in going about its evil work." Rothbard's fulminations notwithstanding, Mr Friedman died a beloved figure of the free-market right. Yet it does seem that his influence on the subject of his greatest technical competence, monetary theory, immediately and significantly waned after his death. This suggests to me that Friedman's monetary views were more tolerated than embraced by the free-market rank and file, and that his departure from the scene gave the longstanding suspicion that central banking is an essentially illegitimate criminal enterprise freer rein. When a significant portion of a political movement's activists believe that the whole point of central banking is "systematic robbery", and that inflation is the means by which this robbery takes place, widespread, reflexive opposition to inflation is not surprising."Of course... Murray Rothbard hasn't been around for a long while to defend his views either, so we should probably take a second and ask ourselves why Rothbard's viewpoint is perhaps more widely accepted now that they're both gone.

I have a few thoughts on this topic, and I think it's best understood from a more personal perspective.

My first introduction to the wide, wide world of economic thought came in high school. I got interested in the subject through philosophy and an ever-present tendency to theorize on human action.

As I began to read books and watch videos on the subject, one name would come up over and over again: Milton Friedman.

Eventually, I discovered books about, and/or by, Milton Friedman and then worked my way through the entire "Free to Choose" series. Not only did I watch the great original version from 1980, I have also watched the entire 1990 "update", which was introduced by none other than my former lecherous Governator himself; Arnold Schwarzenegger.

Friedman was not only every bit the phenomenal debater that The Economist notes in the passage above (and indeed, the NY Times' David Brooks made this point in an interview I recently filmed), he was also simply the best educator on economics that the high school version of me could have hoped for.

He's concise, articulate, and for just about every single question or bit of skepticism I ever had on the topics he presented, he would pre-emptively counter my objections moments later. I frankly find it hard to say a negative word about Milton Friedman as an intellectual... Or rather, I found it hard to say a negative word...

But then something changed.

I read Henry Hazlitt. I read Frederic Bastiat. I read Ludwig von Mises & F.A. Hayek... and most germane to this post, I read Murray Rothbard.

The one question that Friedman never sufficiently answered in a way that I found convincing was; "Why did the Great Depression happen at all?"... And it wasn't until I started reading the Austrians later in my undergraduate college years and when I was in graduate school that it all started to make sense to me why Friedman's conclusions always seemed so weak.

Friedman, to use his pal Thomas Sowell's words, "starts the story in the middle".

When it comes to the Great Depression, Milton Friedman only really looks into what the Federal Reserve did after "Black Thursday" on October 24th, 1929. He and Anna Schwartz don't really bother to spend much time on the cause of the underlying malinvestments and root problems that resulted in the inevitable stock market crash in their book, "A Monetary History of the United States". Instead, they just assume these kinds of fluctuations happen in a market - perhaps randomly - as if J.M. Keynes' notion of the "animal spirits" was a valid concept, rather than the evasion of an argument that it really is.

By contrast, Rothbard, in "A History of Money & Banking in the United States" and "America's Great Depression" spends quite a bit of time on that core issue.

For Friedman, his monetarism and misunderstanding of the Great Depression was not only his biggest mistake (as far as I can tell) as an economist, it's also a huge contributing factor to Ben Bernanke's misunderstanding of the current economic crisis. I've written about this kind of thing in the past, and I don't really intend for this post to be all about why Friedman was wrong on the Great Depression, and why Rothbard's position is far closer to the truth, and I'm not going to go through the copious links from Bob Murphy, Tom Woods, Robert Higgs, Joseph Salerno, et al to back up that case right now.

They're all easily accessible online anyway, so by all means, do some Googling.

What I will do, however, is offer a distinctly third option and alternative assessment of why Rothbard's anti-inflationary ideas and the more "hardcore" strains of free market theory, rather than Friedman's technocratic government "efficiency" aiding positions, are gaining popularity in the libertarian and presumably "conservative" communities right now.

Far from it being a product of Friedman being dead, and thus being unable to act as a "check" on Rothbardian ideas... I suspect it is because, like me, many people are finally accessing the Austrian School account of the Great Depression (thanks largely to the internet archives of places like the Mises Institute or the Foundation for Economic Education" and Ron Paul's political successes) and discovering it to be both more comprehensive and more plausible than the Friedman/Schwartz account.

When looking at the Great Depression and other severe economic crises, I didn't want to simplistically understand the proximate cause of the crash, for example brought on by arguably thoughtless Federal Reserve policies in New York City. I wanted to know about why the American economy was in such a fragile, unsustainable position in the first place.

Understanding the ultimate cause is way more valuable to understanding what to avoid in the future.

I think that a lot of people, particularly in the wake of the 2007 stock market crash (which can be quite explicitly and cogently explained through an Austrian viewpoint - i.e. loose monetary policy and a perfect storm of regulations blew up bubbles in housing & finance, thus causing systemic malinvestment during the boom and an inevitable "bust" to follow), find that Friedman's approach just doesn't do a good enough job of explaining what goes wrong in these situations. And I think that they're finding this to be true precisely because they want to know the bigger picture, and don't really feel like looking at a single snapshot of monetary policy as Friedman did is an adequate data point to explain causation.

And frankly, the United States' experience over the last 3 years attests to this.

Bernanke swore up and down that he learned the lessons Milton Friedman had to teach... and in some ways, I think it's clear that at least on the Great Depression, this is absolutely true. So Bernanke - and the entire political establishment - set about expanding the monetary base, loosening monetary policy, focusing on doing virtually everything possible to pump even more artificial credit into the economy, hoping to avoid the "mistake" of the New York Federal Reserve in 1929.

I think we can see how well that's actually worked out.. By which I mean to say, "not at all".

The multi-trillion dollar stimulus packages that we've gotten foisted on us in the past few years have proven Milton Friedman (to say nothing of Keynes, Krugman or DeLong) conclusively wrong on this issue as far as I'm concerned. If the real problem was lack of credit as the result of a contraction in the money supply in 1929, then by all means, then the Bush/Paulsen or Obama/Geithner (and of course Bernanke) plan to hose down the economy with cheap money should have worked to prevent a long-term recession.

But it didn't.

Most people who are paying attention at all to this kind of stuff (or who haven't been living under a rock since mid-2007) are well aware of this fact. Thus, instead of going back to proximate causes, and searching for that one magic bullet of public policy that would get all the metaphorical "gears" working the right way again, a lot of people are actually starting to try to understand the big, structural problems with the economy.

What at least a number of those people are learning is that these problems simply cannot be solved by pulling the right lever in government.

This is what I figured out after just a few days of being exposed to the Austrian School and thinking through all of the implications of their ideas - particularly on the business cycle, subjective value theory and methodology.

The intellectual satisfaction I felt after having a series of minor epiphanies based on those ideas seriously contrasted against the substantial dissatisfaction I always felt upon thinking through Friedman's viewpoint on the Great Depression, and the cause of recessions in general.

So my suspicion is that the reason Murray Rothbard may seem to be winning the argument over Friedman on monetary policy & business cycle issues today is simply because...

Wait for it...........

He was right.

4 comments:

I love Rothbard, but I think you are wrong. Rothbard overstates his case about inflation. In fact, if you add up the changes in Federal Reserve Credit between June 1921 and June 1929, the amount extended is negative! Rothbard gets around this by calling bills repaid by member banks "uncontrolled reserve", as though the Fed didn't take this into account.

While I respect Rothbard's ability to write convicting monetary and political history, his attempt to fit the buildup to the Great Depression into an Austrian model is a failure. It was the gold in flows that played a large role. Now one can claim that the problems that we experienced were the effects of bad policies by both the U.S and European governments - eg., wartime inflation, an overvalued pound, and the Dawes Plan - but that is not the same thing as saying that it was an example of the ABCT. A more realistic view is that the Great Depression was the result of a myriad of government interventions, but it surely was not caused by an inflationary Fed. On this point, Friedman is right.

Best,

Jim

I certainly agree that Rothbard (and Austrians today, from time to time) overstate inflation. However, I don't think it's possible to look at the amount of money dumped into the economy from 1923-1929 and not see that as a major player in the excesses of the "Roaring 20's".

Obviously, Rothbard covers this fairly extensively in "America's Great Depression"

http://mises.org/rothbard/agd/chapter5.asp

But you are surely correct that inflationary monetary policy is not the *sole* cause.

Of course, I don't believe that it is the sole cause of our current problems either, and that it usually takes a combination of terrible policies to really do the big damage. I mean, if you look at the current problems as a prime example, we saw a huge amount of monetary expansion - but it took a concerted effort by the state to direct that cash into a few specific industries to really cause the major damage in housing & finance.

One thing I am curious about, but how would an inflationary Fed have caused the Depression itself? The inflationary policies of the Fed might have caused the 1920s bubble, but once it popped in 1929, what then led to the Depression? Because we didn't get a depression after the 1987 bubble, which was twice the size of the 1929 bubble in terms of how far the markets declined (24% as opposed to 12% in 1929), or after the 2000 bubble burst, which was twice the size of the 1987 bubble. So why did the 1929 bubble lead to a depression?

Hoover and FDR's central planning and protectionist policies were no help, but I do believe that the Fed's allowing the money supply to collapse after the crash contributed greatly to creating the Depression.

This is actually where I think a blend of Rothbard with Friedman and Schwartz is key.

You have the inflationary bubble that goes into the 1929 crash, but then you have a sharp contraction in the money supply along with price controls, tariffs, and a bunch of other really bad policies. I think that all combined is a pretty clear recipe for economic disaster, only exacerbated by FDR

Post a Comment